A recent report from Deloitte recommends that organizations take a sustainable expense management (SEM) approach to managing, controlling, and optimizing costs.

This approach empowers all stakeholders with a 360 view of expenses, so costs can be controlled before they spiral out of control before they happen. This report unpins the challenges organizations face when reporting expenses using manual methods with Excel, emails, or legacy systems.

Challenges in manual expense reporting

I wholeheartedly agree with the Deloitte report, and here I highlight some of the challenges I have observed with manual expense reporting including:

-

Inaccurate data: While expenses can be tracked via emails, paper, or spreadsheets, these methods can lead to incorrect data or corrupted files. Inaccurate data can challenge the finance team as they attempt to reconcile expenses throughout the financial year.

-

Missing invoices: Invoices can be collated via email or Excel and stored via a local host. While this approach may be effective for certain smaller organizations, there is a risk of invoices being lost in email chains or files stored in hard-to-access locations. Additionally, retrieving invoices for financial year reporting can be a time-consuming process.

-

Poor forecasting: Forecasting is the cornerstone of every finance department. Expense forecasting can be challenging when data is scattered across disparate locations and not accessible in a central location or available real-time.

-

Delay in reimbursing employees: Organizations relying on legacy technologies or manual methods to manage expenses may face slow processes, resulting in delays in reimbursing employees. This can negatively impact employee morale and satisfaction.

-

Inefficient working: Managing expenses manually is an inefficient approach for both the finance team and the broader teams submitting expenses. Hours spent with manual data entry is wasted effort.

What is expense management automation?

Now that we have established the challenges of managing expenses using manual data, emails, spreadsheets, or legacy technologies, let's look at a world where expense management is automated.

Expense management automation involves utilizing a digital platform to streamline and replace traditional manual methods of managing expenses, such as relying on Excel, emails, or local storage for invoices and records.

A digital process automation platform helps organizations create, store, and report on expense management via digital workflows. Automating expense management removes risk, improves expense visibility, and enhances employee experience.

How to automate your expense management in 5 steps

1. Select the right expense management automation platform

This is probably the most critical step to a successful expense management automation strategy. Here are some tips to find a solution that will deliver long-term value for your organization.

-

Integrations: Finding a platform that integrates with your existing finance system will be key to the success of your expense automation project.

-

User Experience: Review the usability of the platform and ask other team members to interact with the platform. This will provide valuable user experience feedback to inform your decision-making.

-

Reviews: Third-party and independent customer reviews are an excellent way to verify the claims of a platform. You may even ask for a reference customers to speak with and provide a reference point to support your selection process.,

-

Provides onboarding: Technology adoption is critical to the success of expense management automation. Find a platform that provides onboarding learning and development opportunities so that users are able to hit the ground running.

-

No Code: With increasing demands on the IT team, sourcing an expense management system that provides no code workflow automation features is critical. No code platforms empower users beyond IT to automate, driving digital transformation and expanding automation initiatives.

-

Expense reporting automation: Find a solution that will automate expense reporting so that your teams will have visibility of expenses anytime and anywhere.

-

Offers free trial: If you are going to invest time, resources, and energy into an expense management system, you need to ensure that it will deliver on your business goals. One way to test a platform's performance, functionality, and usability is to test it in a real-world environment. Platforms such as FlowForma Process Automation provide free access to features and functionality so that you can test the platform by automating an expense management process in a risk-free environment.

At FlowForma, expense management is always a hot topic among customers and partners that we speak with. One success story of success expense automation is with Abingdon & Witney College.

Abingdon & Witney College is based in Oxfordshire United Kingdom. The college provides a huge range of courses – from part-time and full-time, delivered to 14,000 students. Like many education organizations globally, Abingdon & Witney College recorded their expenses via an Excel spreadsheet. The spreadsheet was shared internally between employees, managers, and the HR department.

This method of expense management was slow, risked file corruption, and provided a sub-optimal experience for all stakeholders in the process. Abingdon & Witney College replaced their old manual process with a digital workflow that automated their entire process.

The impact of expense automation was significant. Improved communications, data visibility, risk management, and productivity improvements were immediate. With expense automation, Abingdon & Witney College was able to save 402 hours admin hours. That's over one year of work by automating a single process!

Learn more about the Abingdon & Witney College case study here.

2. Design your expense management workflow

Once you have an expense management automation platform in place, the next step is to use a flow designer to map out your expense process. This will need to include the steps, stakeholders, and platforms involved in the expense process.

By mapping out the workflow, you'll quickly identify areas that may have a more specific technical focus, such as integrations. You'll also be able to set up rules required for any step in the process and include multiple stakeholders in the flow.

If your organization uses external contractors, you'll need to include them in your flow so that expenses can be captured, reported, and audited on a regular basis.

3. Integrate with existing systems

Once you have designed for workflow and have full visibility of the steps, stakeholders, and systems at play, you'll need to make sure data is connected via your process automation platform and existing systems. This will help ensure that data is consistent, accurate, and reportable.

A platform such as FlowForma Process Automation is quickly and easily integrated into thousands of systems using a No Code Web API.

3. Implement a training program

Technology adoption is a key step in ensuring that expense management is automated within a process automation platform successfully. From our experience, we see that training users on how to operate a platform will drive user adoption and ensure the success of the automation strategy.

4. Upload expenses

4. Upload expenses

Once your digital expense management process is live, you can immediately invite employees and external users to capture receipts and upload expenses.

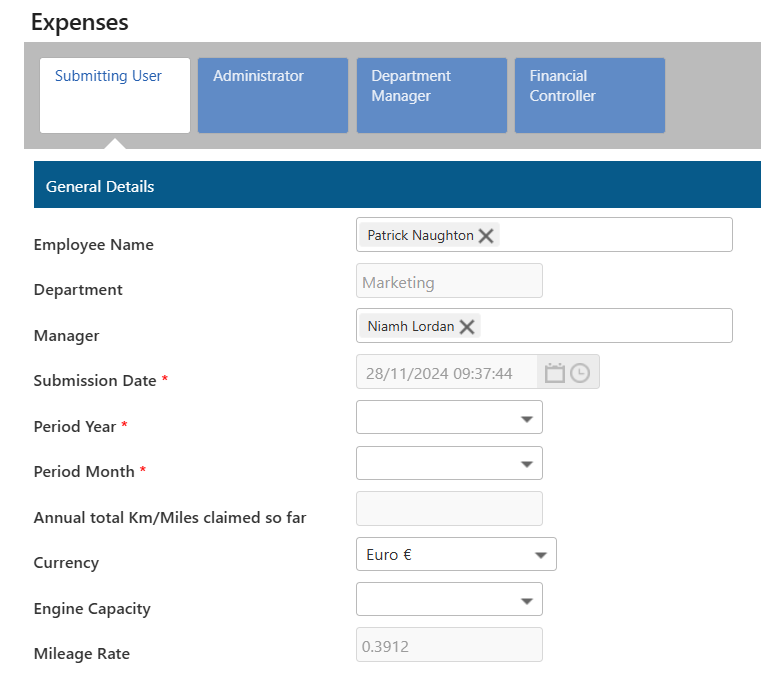

As you can see from this screenshot from an expense management workflow from FlowForma Process Automation, the expense form can be delegated across departments when approval is required.

In this instance, the administration, department manager, and financial controller are involved in the expense process.

Automating this process simplifies data collection at every stage, enabling rapid expense processing while empowering managerial and financial teams with the visibility required to manage expenses effectively.

5. Start collecting expense data and create your reports

Once users complete the automated expenses form, data will be available in real time. Expense reports can be created to showcase trends, identify issues, and forecast expenses.

In the example here we can see how expense management can be made easier with a visually rich dashboard of expense claims. Visualizing expenses can help decision-makers with:

-

Identifying trends in departments

-

Which employees incur the most expenses

-

Identifying trends across months and years

-

Add expenses to the overarching finance department budget

Benefits of automated expense management

-

360-degree view of expenses: With automated expense management, the finance team will have full visibility into expense data. Hosting expense data in one central location will provide a real-time view of expense costs, help forecast expenses, and provide faster expense reimbursement for employees. With access to data in real-time, finance leaders will be equipped to make better-informed decisions based on accurate expense data.

-

Remove manual data entry: Extracting data from different platforms is time-consuming and an inefficient way to work. Using a digital automation platform to automate the management of business expenses will reduce the burden of manual data entry and free up time for all stakeholders to focus on more value-adding tasks.

-

Managing risk: Automated expense management will provide organizations with an audit trail of expenses. With a visible trail of expenses, organizations will reduce the risk of expense fraud.

-

Improves productivity: Automating expense management removes manual, laborious, and inefficient tasks. Replacing old ways of working with streamlined and automated workflows drives productivity improvements for finance teams, employees, and external contractors.

-

Streamline travel: Expense management automation empowers employees to submit their expenses anytime, anywhere, thanks to the convenience of mobile apps designed for seamless submissions.

-

Improved employee and contractor satisfaction: A key benefit of expense management automation is improved employee and contractor satisfaction. With a streamlined experience, employees with get a better user experience. Expenses will also be paid faster with better visibility and management of expenses by the finance department.

Conclusion

Expenses management doesn't have to be complicated and relying on emails, spreadsheets, or legacy technologies to record expenses can have a negative business impact.

Investing in an expense management automation platform will streamline expense management while managing risk, drive productivity gains, and result in better employee and contractor experiences.

By following clear steps, you can efficiently automate expense management using the right process automation platform. Contact FlowForma today to experience how fast, simple, and intuitive expense automation can be.